Published by: Housley Carr

Private equity is playing a critically important role in the build-out of crude oil gathering systems in the Denver-Julesburg (D-J) Basin, where rising production volumes — and the expectation of further growth, especially in and around Weld County, CO — are spurring a number of major projects. For proof, you need look no further than ARB Midstream, which, with backing from Ball Ventures’ BV Natural Resources, has developed the largest privately held crude transportation and storage network in the D-J through a combination of acquisitions and new construction. Producers have dedicated a quarter of a million acres to it. Today, we continue a series on crude-related infrastructure in the D-J with a look at ARB Midstream’s fast-expanding asset base there.

Midstreamers supported by private equity have been the focus of two of the three blogs on D-J crude gathering systems we’ve already posted. In Part 1, we discussed the sprawling Black Diamond crude gathering system in Weld County that is co-owned by publicly traded Noble Midstream Partners and PE-backed Greenfield Midstream, which was established in 2017 with financial backing from EnCap Flatrock Midstream. Part 2 reviewed Noble Midstream’s nearby Wells Ranch, East Pony, Greeley Crescent and Mustang systems, and Part 3 considered the crude transportation network now being expanded by Denver-based Taproot Energy Partners, a year-and-a-half-old company with financial backing from Energy Spectrum Partners.

Before we delve into ARB Midstream’s extensive pipe and storage holdings in the D-J Basin, we’ll provide a brief reminder that the D-J area in northeastern Colorado and southeastern Wyoming offers an unusually intense concentration of hydrocarbons within four geologic layers, or “benches,” only a few thousand feet below the surface, as well as low per-well drilling costs and direct pipeline access to the crude oil hub in Cushing, OK. We also should point out that D-J crude production has doubled in the past 18 months to almost 650 Mb/d, and that the vast majority of the basin’s production growth has been occurring in Weld County, making it the epicenter of midstream development activity as well.

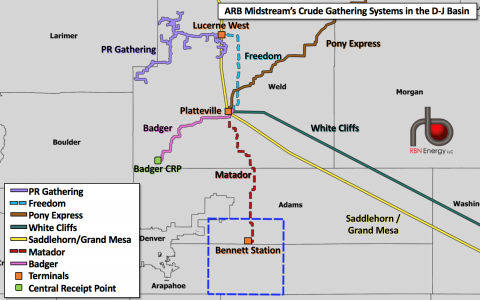

ARB Midstream was founded in September 2014 by two former executives at NGL Energy Partners and the CEO of Ball Ventures, a private equity investment firm based in Idaho Falls, ID. ARB’s financial backing comes from Ball Ventures’ BV Natural Resources unit, which focuses on energy-related investments. The midstreamer’s initial steps were to develop crude-by-rail terminals in the Niobrara and the Permian. In September 2016, ARB made its first foray into crude gathering in the D-J with the acquisition of the Platte River (PR) Gathering System from Rimrock Midstream Holdings. The Platte River system (lavender line in Figure 1), which is located in west-central Weld County, is supported by multiple long-term producer commitments and has been operational since April 2016. The system started out small, with fewer than 10 miles of pipe, but ARB has since added more than 100 miles to it, mostly pipe 12 inches in diameter. The system runs to ARB’s Lucerne West Terminal (uppermost orange square), where the company has built 170 Mbbl of storage capacity and has permits in hand for an additional 450 Mbbl of storage. The terminal also has four truck-unloading stations. Lucerne West is interconnected to the Grand Mesa Pipeline (yellow line), which runs as part of Saddlehorn/Grand Mesa pipeline system to the Cushing, OK, hub. However, as we’ll get to in a moment, ARB is in the final stages of installing a new pipe that will enable crude to flow in either direction between Lucerne West and a terminal in Platteville, CO, that is linked to other takeaway pipelines to Cushing.

Figure 1. ARB Midstream’s Crude Gathering Systems in the D-J Basin. Sources: ARB and RBN (Click to Enlarge)

Before we get to that pipeline between Lucerne West and Platteville, though, we’ll look at two new crude pipelines that ARB Midstream has been developing to the southwest and south of Platteville. The first of these, the Badger Pipeline (pink line), which has been operational since October 2019, has 32 miles of mostly 12-inch-diameter pipe, and runs to Platteville from ARB’s new Badger central receipt point (CRP; green square). The Badger system’s throughput capacity is 90 Mb/d. At Platteville, the company leases two 150-Mbbl tanks from Saddlehorn Pipeline Co., a joint venture of Magellan Midstream Partners, Plains All American and Western Midstream Partners. (More on the Platteville Terminal and takeaway pipes in a sec.)

ARB Midstream is nearing the completion of its planned Matador Pipeline (dashed red line), which will have 38 miles of mostly 16-inch-diameter pipe from the recently finished Bennett Station (lower orange square) in Adams County, CO, to the Platteville Terminal. The Matador system’s throughput capacity will be about 220 Mb/d. The Bennett Station has two truck unloading stations, 160 Mbbl of existing storage capacity and permits to build 480 Mbbl more. ARB also is developing an infield gathering system (within large dashed blue square) to provide transportation to Matador. ConocoPhillips recently confirmed that it has negotiated a contract to sell 97,000 acres in the Matador area to Crestone Peak Resources, and we hear that drilling activity is expected to begin after the deal closes.

Finally, in the first quarter of 2020, ARB expects to begin operation of its new 12-inch-diameter, bi-directional Freedom Pipeline (dashed aqua line) between the Lucerne West and Platteville terminals. Freedom, with a capacity of 150 Mb/d, will give shippers the flexibility to either (1) move barrels gathered on the Platteville River system south from Lucerne West to Platteville, or (2) move barrels gathered on the Badger and Matador systems north from Platteville to Lucerne West.

As we noted earlier, the Lucerne West Terminal is connected to the Grand Mesa Pipeline. The Platteville Terminal, in turn, is linked to the Saddlehorn Pipeline and to Tallgrass Energy’s Pony Express system (brown line). Platteville also will tie into the White Cliffs Pipeline (dark green line) in 2020, and a connection to Phillips 66 and Badger Pipeline’s planned Liberty Pipeline (not shown) is possible once that line starts up in early 2021. (Liberty will run from the Bakken to Cushing via the Powder River and D-J basins.) We should note that Matador will be the origination point for the joint tariff between ARB and Saddlehorn for delivery from Bennett Station to Cushing.

We mentioned in our recent blog on Taproot Energy Partners’ D-J gathering system that crude quality has become a major opportunity in the basin, with “Niobrara-spec” crude (with an API gravity of less than 42 degrees) commanding a price premium over “D-J Common” oil (with an API gravity of 44 to 46 degrees or higher). Our understanding is that most of the crude gathered by ARB Midstream’s Platte River system has an API gravity of 42 to 44 degrees, while most of the Badger system’s crude would be categorized as D-J Common (44 to 46 degrees). Crude on the Matador system is generally higher-value Niobrara spec, in this case with an API gravity of 38 to 40, or a couple of degrees below Niobrara-spec’s 42-degree upper limit. The layout of ARB’s pipeline and storage assets gives the midstreamer the ability to segregate the barrels it gathers on each of the systems — in fact, one of the two 150-Mbbl tanks that the company leases at the Platteville Terminal stores only Niobrara spec and the other stores only D-J Common.

Lastly, we should explain that Matador Pipeline uses 16-inch-diameter pipe because the well pads to be served by Matador are — or are expected to be — prolific producers. Many wells may have a 30-day initial production (IP) rate of 700 b/d or more — two and a half times the typical wells in other parts of the D-J. Also, at least for now, Matador will be the only pipeline connection between its area and Platteville. In the next episode in this series, we’ll discuss another set of D-J Basin crude gathering systems.

Link to full article here: https://rbnenergy.com/40-miles-from-denver-part-4-pe-backed-arb-midstreams-d-j-basin-crude-gathering-systems